vermont state tax return

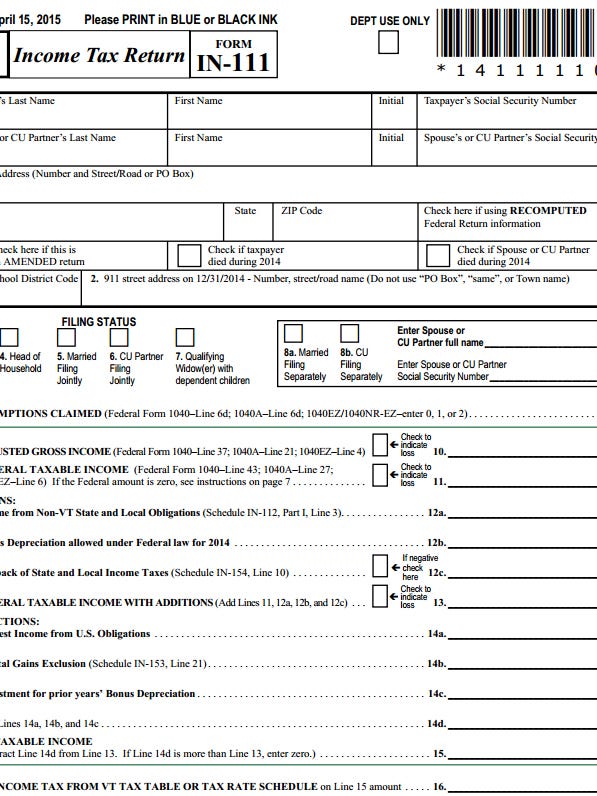

Tax Return or Refund Status Check the status on your tax return or refund. Paying Tax Owed On Your Income Tax Return.

Vt Dept Of Taxes Vtdepttaxes Twitter

File your return electronically for a faster refund.

. ACH Debit free Credit. Fact Sheets and Guides. Direct Deposit is not available for Vermont.

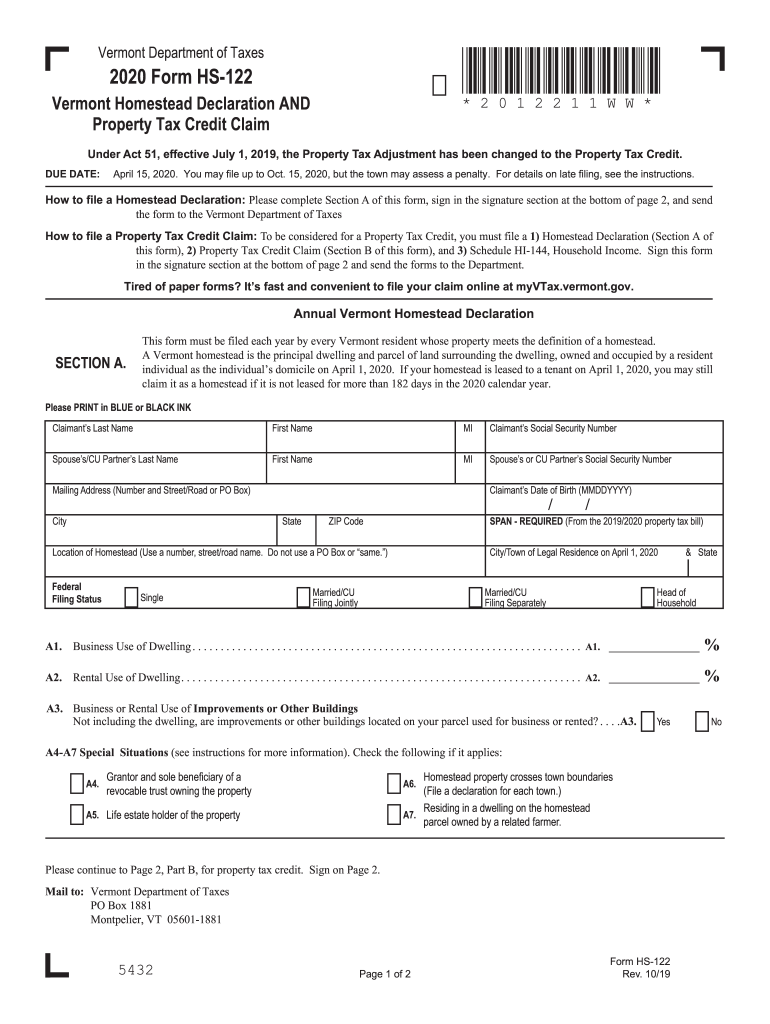

Go to myVTax for more information. Vermont State Income Tax Return forms for Tax Year 2022 Jan. As a general rule taxpayers are required to use the same filing status for their Vermont income tax return as they do on their federal return.

Details on how to only. How to Check Your Vermont Tax Refund Status. State Employee Phone Directory Search for contact information for all State of Vermont employees.

Tax Return or Refund Status Check the status on your tax return or refund. State Employee Phone Directory Search for contact information for all State of Vermont employees. 185 rows Estate Tax Return - death occurring before or on Dec.

Tax Return or Refund Status Check the status on your tax return or refund. Preparation of a state tax return for Vermont is available for 2995. You may pay your income tax estimated income tax and any Vermont tax bill online using one of the following.

Vermont State Income Tax Forms for Tax Year 2021 Jan. State Employee Phone Directory Search for contact information for all State of Vermont employees. E-File is not available for Vermont.

If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO. Once processed it may take 5 to 7 business days for your refund to appear in your bank account or on a prepaid debit card. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

All Forms and Instructions. Understand and comply with their state tax obligations. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment.

If you file a tax. If you cant file your. If you were required to file a federal tax return in 2019 made more than.

Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund Checks can be cashed up to 180 days after the issue date. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Vermont Income Tax Forms.

Line-by-line instructions for complex tax forms can be found next to the file. Box 1881 Montpelier Vermont 05601-1881. Nonresident Spouse with no Vermont Income.

Anyone who lived in Vermont for only a portion of the year or fewer than 183 days is a part-year Vermont resident. 31 2022 can be e-Filed along with an IRS Income Tax Return by the April 18 2023 due date.

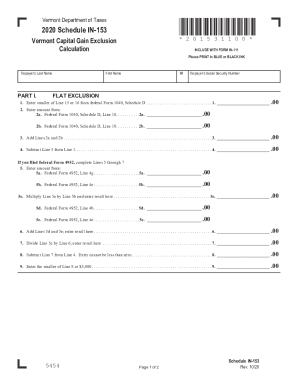

Vermont Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In Vermont Taxvalet

Vt Suspends Tax Refunds Over Fraud Concerns

Tax Department Sending Letters To 20 000 Vermonters

Form In 111 Fillable Vermont Income Tax Return

8879 Vt C Fill Out Sign Online Dochub

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Montpelier Vt

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Vermont Promotes Free Tax Preparation Help Vtdigger

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Vermont Student Loan Forgiveness Programs

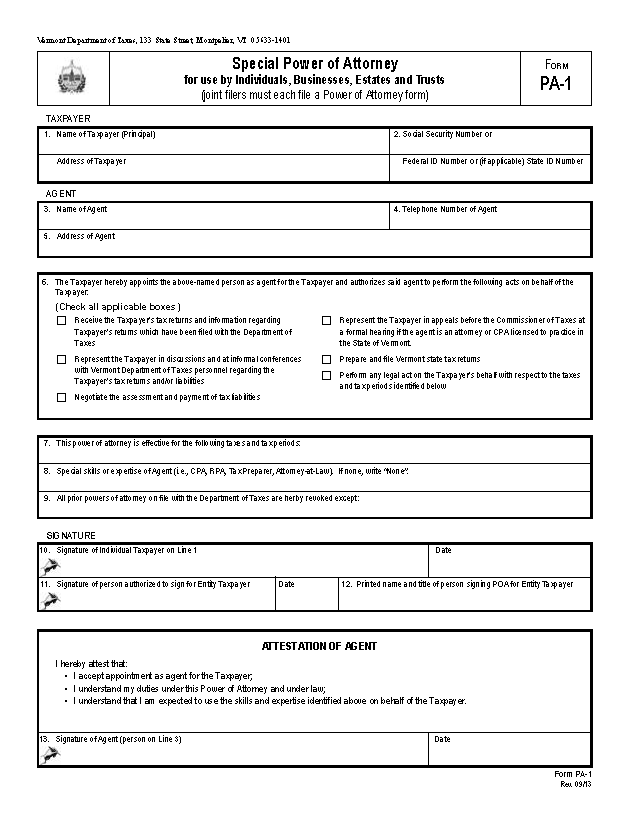

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Word

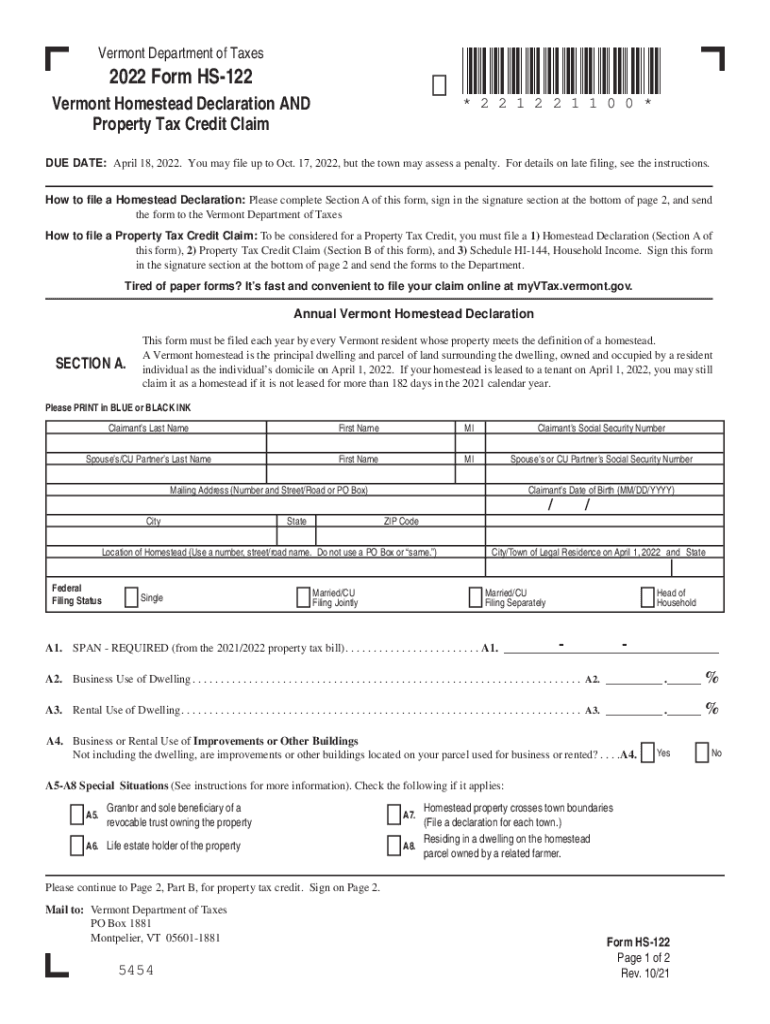

2022 Form Hs 122 Fill Out Sign Online Dochub

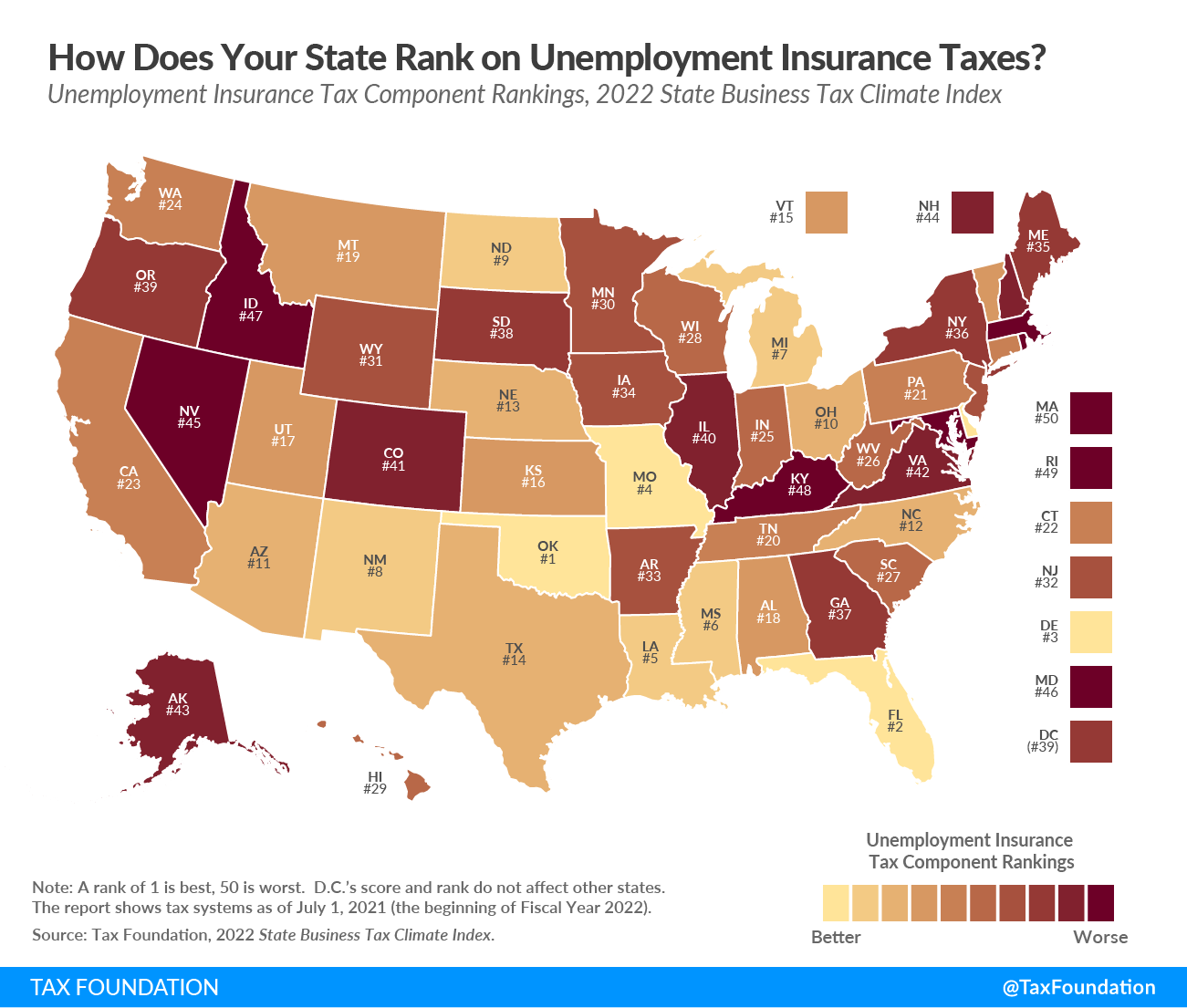

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

50 000 More Vermont Returns Expected By Wednesday Tax Deadline Vtdigger

State Corporate Income Tax Rates And Brackets Tax Foundation